After steadily declining following an 8% high, mortgage rates have increased for the second consecutive week Thursday.

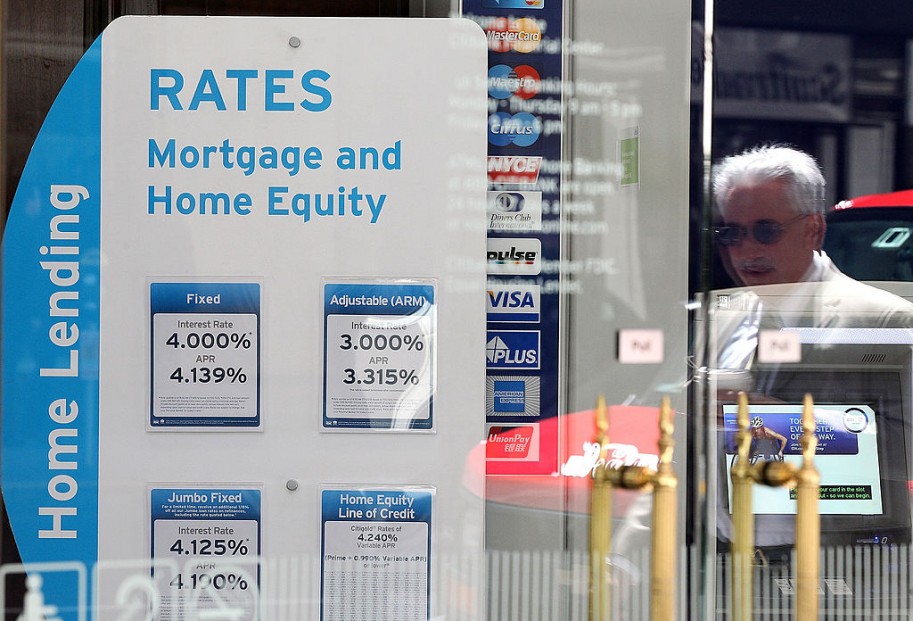

The 30-year fixed rate mortgage climbed to 6.77% this week, up by 0.13 percentage points from last week's 6.64%, according to Freddie Mac's latest Primary Mortgage Market Survey (PMMS). A year ago, the average 30-year fixed rate was 6.32%.

The rate on the 15-year fixed mortgage also increased this week to 6.12%, up 0.22 percentage points from last week's 5.90%. During the same period last year, the 15-year fixed rate averaged 5.51%.

"On the heels of consumer prices rising more than expected, mortgage rates increased this week," Sam Khater, Freddie Mac's chief economist, said in the report. "The economy has been performing well so far this year and rates may stay higher for longer, potentially slowing the spring homebuying season."

The average mortgage rate is calculated based on the number of mortgage applications that Freddie Mac receives from thousands of lenders in the country. The PMMS only includes borrowers who put 20% down payment and have excellent credit scores.

Home Prices Also See Increase

In addition to rising mortgage rates, home prices across the country also rose, edging out further prospective buyers who are increasingly being priced out of the market. The median sale price rose 6.1% year-over-year in the week ending Feb. 11, marking the biggest bump recorded since October 2022, as reported by Redfin.

The median sale price of homes increased the most significantly in five metro areas, including Newark, New Jersey, 14%; New Brunswick, New Jersey, 13.8%; Miami, 13.2%; Anaheim, California, 12.8%; and Warren, Michigan, 12%. The median sale price only declined in three metros, specifically in San Antonio, Austin, and Fort Worth, Texas.

Several factors have affected the recent housing market, including competition among prospective home buyers. Redfin's report noted that at least 22% of homes were sold above the final list price, up from 20% last year.

In addition, strong employment numbers also contribute to rising mortgage rates and home prices. In January alone, the U.S. added 353,000 jobs, which is almost double the amount expected by the Labor Department.

READ NEXT: Pending Home Sales Sees Significant Decline as Mortgage Rates Climb To Highest Since December